01 Aug 2020 US Administration deterrence against ESG strategies

Despite the worldwide increase in ESG and sustainable investments, in the USA we are assisting to a great deterrence against ESG policies reviving the old objection they provide low returns, which has not been supported by the facts.

In the last decade, a fundamental shift towards sustainable investment, a strategy seeking both returns and long-term development, has rapidly taken place within the financial industry. Early conventions placing shareholders and profits as the core elements of businesses are becoming obsolete, however, in the USA we are assisting to a great deterrence against ESG policies reviving the old objection they provide low returns, which has not been supported by the facts.

This old argument is now affecting US private pension funds. Last June, the Department of Labor set out guidelines that would require pension administrators to prove that no financial sacrifice was made by putting money in ESG-focused investments. Policy facing backlash by a growing group of organizations and investors calling for the DoL to roll back its proposals as in their view it would only deprive individuals of long-term growth and lower risk opportunities.

In a response to DoL, Ceres, a non-profit advocacy group, said the proposed rule “reflects an outdated view that ESG factors are non-financial and considering them can lower returns”.

Unfortunately, it is not only institutional investors that have been affected by new policies deterring ESG growth. As part of its deregulation campaign, the SEC is said to consider changes to Rule 14a-8, the process that determines shareholder access to corporate proxies. Under the current ruling, a shareholder must hold at least $2,000 or 1% of a company’s securities for a year to be eligible to submit a proposal. The chance would eventually increase this requirement making it more difficult for small-size investors to actively engage in corporate governance. Some of the most significant changes to corporate behavior—from addressing greenhouse gas emissions to reining in excessive executive pay— have come from this rule.

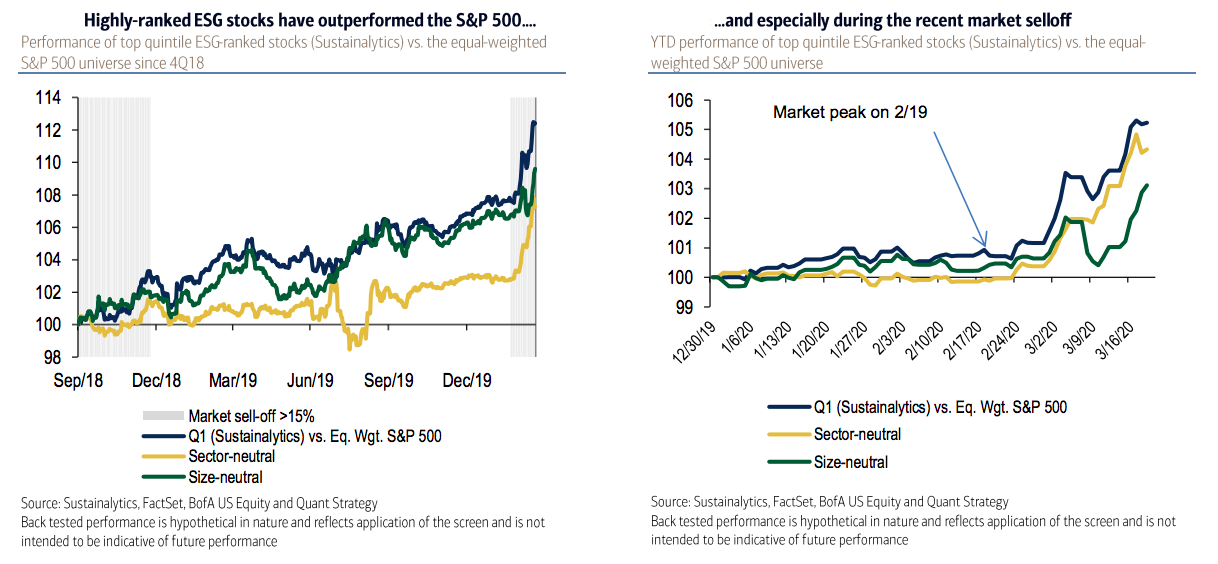

The evidence in favor of sustainable growth is, however, clear. A study conducted by Bank of America found that companies with high ESG scores generally saw lower future earnings volatility, as well as a lower probability of bankruptcy. Adding to it, among U.S. companies on the S&P 500 index, those that scored in the top fifth of ESG rankings outperformed their counterparts by at least three percentage points every year for the past five years. And according to a report released by Deloitte, good corporate governance enhances higher performance, as it provides tools to structurally improve the decision-making process and thus the firm’s value.

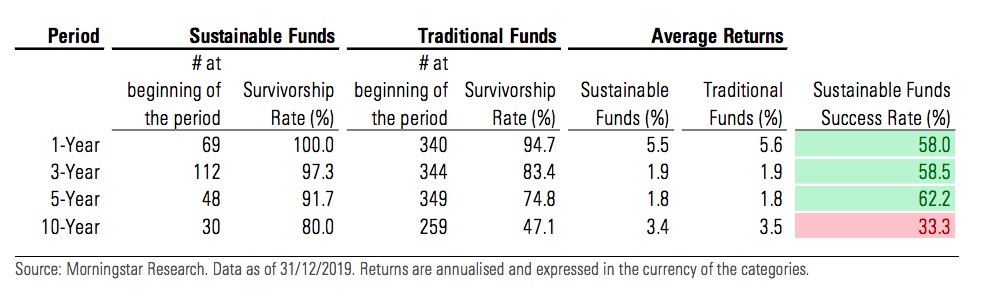

As a stark contrast with European regulations, where long-term sustainability is placed at a central stage, the ECB is said to explore different opportunities to combat climate change setting green targets, including through its flagship bond-buying program. A study conducted by Morningstar that examines the long-term performance of 745 Europe-based sustainable funds shows that the majority of sustainable strategies have done better than non-ESG funds over one, three, five and ten years periods. Furthermore, on average, sustainable funds have had a longer life span than non-ESG investment vehicles: 77% of ESG funds that were available 10 years ago still exist, compared with 46% for traditional funds.

For further information, see the following links:

- https://www.ft.com/content/128c5c92-203b-4a87-8f53-315b23018f9a?desktop=true&segmentId=7c8f09b9-9b61-4fbb-9430-9208a9e233c8#myft:notification:daily-email:content

- https://www.bofaml.com/content/dam/boamlimages/documents/articles/B4_009/ESG_Bull_Market_Phenomenon_Quite_the_Contrary.pdf

- https://www.morningstar.com/content/dam/marketing/emea/shared/guides/ESG_Fund_Performance_2020.pdf

- https://www.ft.com/content/abfa7a6f-79e3-4abd-9aee-93d99384ef36

- https://www.marketwatch.com/story/the-sec-wants-to-change-the-rules-for-filing-shareholder-motions-for-no-good-reason-2019-11-01

- https://www.ft.com/content/f776ea60-2b84-4b72-9765-2c084bff6e32