03 Aug 2020 The EU TAXONOMY for SUSTAINABLE FINANCE

According to the OECD, globally, EUR 6.35 trillion a year will be required to meet the Paris Agreement goals by 2030. The EU Taxonomy will help investors and companies in choosing green opportunities that are in line with a low carbon economy and resource-efficient economy.

Finance enables transformative improvements in industries all over Europe and globally. According to the OECD, globally, EUR 6.35 trillion a year will be required to meet Paris Agreement goals by 2030. Public-sector resources will not be adequate to meet this challenge, and mobilization of institutional and private capital will be necessary.

The EU Taxonomy categorizes the economic activities that substantially contribute to two goals, mitigation of and adaptation to climate change. It will be implemented in future national-level regulations and will be paramount for the success of the EU climate targets. The Taxonomy will help investors and companies in choosing green opportunities that are in line with a low-carbon economy and resource-efficient economy.

What is the EU Taxonomy and what are its main features?

The EU Taxonomy Report published in March 2020 is the result of an arduous work of the Technical Expert Group on Sustainable Finance (EU TEG) on specific actions of the EU Action Plan on Sustainable Finance. The report consists of a classification system that enables the categorization of economic activities/sectors that play crucial roles in climate change mitigation and adaptation.

The Taxonomy sets performance thresholds (referred to as ‘technical screening criteria’) for economic activities which:

• make a substantive contribution to one of the six environmental objectives listed in Figure 1 below;

• do no significant harm (DNSH) to the other five, where relevant;

• meet minimum safeguards (e.g., OECD Guidelines on Multinational Enterprises and the UN Guiding Principles on Business and Human Rights).

The classification consists of a series of technical screening criteria, methodology and guidance described in the EU Taxonomy report which the Technical Expert Group on Sustainable Financehas been busy designing, together with stakeholder consultations, involving numerous experts from all of the sectors covered by the taxonomy.

How is the EU Taxonomy going to impact their company AND the investors’ community?

The Taxonomy will have a wide range of implications for investors and issuers working in the EU, and beyond. These include:

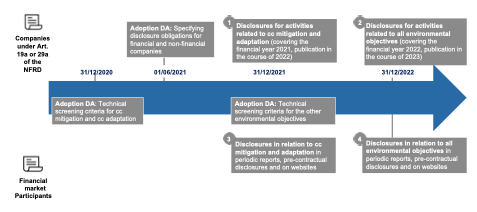

- Reporting. Financial markets will be required to complete their first disclosure against the Taxonomy, covering activities that largely contribute to climate change mitigation and adaptation, by the 31st of December 2021. Companies will be required to disclose in the course of 2022. The technical screening criteria will be issued as part of the specific legal requirements from the European Commission by the end of 2020.

- Disclosure of capital and operational expenditure. Financial and non-financial companies under the scope of the Non-Financial Reporting Directive (NFRD) will be required to disclose, in their annual financial reports, as well as any capital or operational expenditure associated with Taxonomy-aligned activities. The objective is to provide investors with the data needed to be able to direct their capital to sustainable investments.

- New eco-labelling and standards. The European Commission plans to introduce eco-labels and the extend to financial products. Detailed eco-labelling requirements are yet to be set. Standards for green debt are also in development. A Green Bond Standard will require debt instruments to outline the use of proceeds that align with the Taxonomy.

The main obligations for financial market participants and large companies are reported in Fig. 2.

What are the next steps they should be aware of?

In establishing thresholds for Taxonomy screening criteria, the TEG highlights the EU climate change mitigation objectives to reach a net-zero emissions by 2050 and a 50–55% reduction by 2030, consistent with the commitments under the EU Green Deal. It is an extremely ambitious goal that will be strictly implemented through the Taxonomy.

In the years to come, we will see the introduction of measures to clarify asset managers’ and institutional investors’ duties regarding sustainability, as well as strengthening the transparency of companies on their environmental, social and governance (ESG) policies.

In the next years, it can be expected that actors in the financial market will look much more closely at the activities they are investing in or financing. Prior to the Taxonomy, it was easier to hide investments that were not sustainable from the climate perspective. This is no longer an option, the requirement to disclose massive stranded assets and carbon-heavy indicators will make it harder for non-sustainable projects. The introduction of a ‘green supporting factor’ in the EU prudential rules for banks and insurance companies means incorporating climate risks into banks’ risk management policies and supporting financial institutions that contribute to fund sustainable projects. Moreover, the Commission will evaluate the current reporting requirements for issuers to make sure they provide the right information to investors.

In the future, all of the investments and financial activities that are marketed as financing the transition to climate mitigation or adaptation objectives will need to be explained according to the Taxonomy criteria. Disclosures and reporting in this area will help the market reveal whether the environmental performance of a specific economic activity is making a substantial contribution to climate mitigation objectives or it is not aligned with the Paris Agreement objectives on CO2 emissions.

For further information, see the following links:

https://www.bbva.com/en/what-is-the-taxonomy-for-sustainable-finance/

https://home.kpmg/fi/fi/home/Pinnalla/2019/08/eu-sustainable-finance-explained-part-ii-taxonomy.html