27 Aug 2024 An overview of the Impact Investing market

As the urgency to achieve the 2030 Sustainable Development Goals (SDGs) and net-zero emissions by 2050 intensifies, impact investing has emerged as a powerful and essential tool to help meet these targets. Indeed, the Global Impact Investing Network (GIIN), which defines impact investments as “investments made with the intention to generate positive, measurable social and/or environmental impact alongside a financial return”, has estimated that, in 2022, the size of the impact investing market reached the critical milestone of USD 1.164 trillion of assets under management (AUM)[1]: these represent a key resource employed in filling the funding gap existing to achieve the SDGs, and expectations are that the market will keep growing.

Indeed, if in 2021 investments in ESG equity funds reached historical records, with over USD 300 billion invested, these are now declining: ESG investments are decreasing significantly, especially in the face of unsatisfactory financial performance, “greenwashing”, and the increasing politicization of the issue[2] (see also this SVI post of 21/08/2024 ‘The ESG Debate: Is The ESG Party Over In The Usa And In Europe?’[3]).

On the other hand, investments in Green Bonds, forms of debt linked to performance on ESG issues and used by countries and companies to finance environmental projects and thus falling under the GIIN definition of impact investments, continue to grow[4].

There are several factors contributing to the growth of the market. First, the importance of impact investing resides in its ability to align investors’ values with their investment activities, producing social and environmental change. The growing evidence that there is potential for financial returns from such investments has contributed to shifting the mindset that saw a trade-off between achieving impact and obtaining market-rate returns.

This has led to an increase in investors’ confidence to allocate resources towards producing positive change, breeding greater market-level adoption, and expanding products offered and strategies[5] across asset classes, geographies, and impact themes.

There is agreement on the growth of the impact investment market, however, no full consent about its size. The exercise of assessing the market size for impact investments is made difficult by its relative novelty, lack of uniform regulations and different definitions of what type of assets to include. For instance, impact investors can have a “finance-first” approach and thus consider only investments that achieve fully commercial, risk-adjusted returns. Others can have an “impact-first” attitude and choose investments that maximize impact over return. Depending on the definition guiding them, databases of impact investors may thus differ greatly.

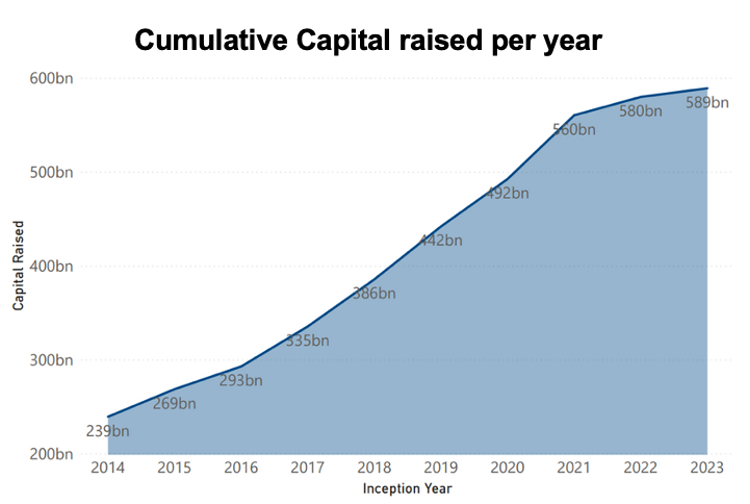

Phenix Capital Group, an investment consultant that aims at catalyzing institutional capital towards the SDGs, has mapped the impact fund universe, identifying 2,604 impact funds (1,160 of which are in Europe) in their dataset[6] as of end of 2023. Their research shows that between 2022 and 2023, the sector has grown both in terms of new funds launched, a growth rate of 16.7%, and, in terms of total committed capital, which now stands at €589 billion (half the figure measured by GIIN, having grown by 9.3%.

The slowdown in the pace of growth that is noticeable from 2021 should be ascribed to the overall environment adverse to investments resulting from the recent negative economic conditions. Nonetheless, according to Phenix Capital Group’s CEO, Dirk Meuleman, impact and sustainble investing have the characteristics to be more resilient than other investment categories, as they focus on sectors that are less volatile and have good long-term growth prospects: “In impact investing, you typically have more funding in the healthcare space and agri-food, for example, and those are very robust sectors to invest in, even with a very uncertain macro-economic climate, because health issues are rising due to the ageing population in most of the West, and we have a growing global population that needs to eat”[7].

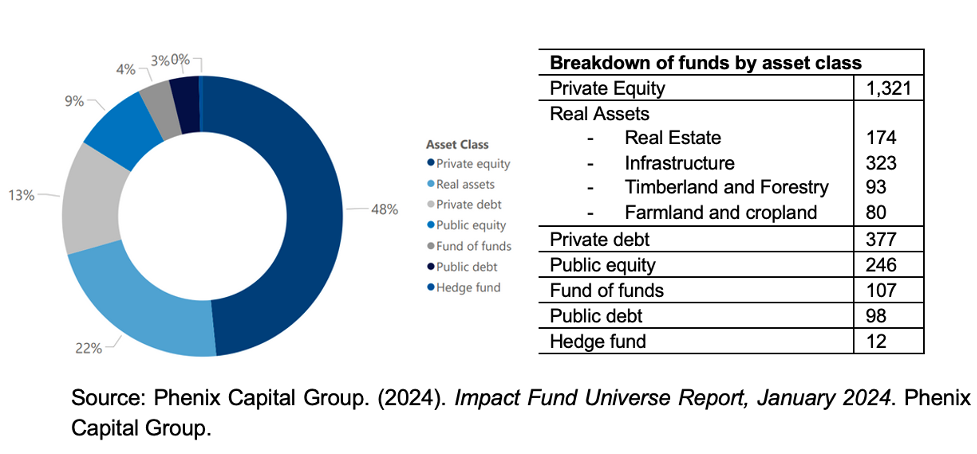

Overall, impact funds are distributed across different investment strategies by asset class, the most popular of which is private equity, that, as reported by Phenix Capital Group, currently counts 1,262 funds which have raised EUR 164 billion comulatively.

The breakdown of funds, as percentage of total funds and number of funds, is shown below (funds are assigned to the asset class that best describes their strategy):

A further contributing factor to the growth of the market has been policy support which has helped attract a broader range of investors. For instance, major drivers of the popularity in clean energy investing were the European Green Deal as well as the Inflation Reduction Act, which was passed in the United States in 20225: the IRA has been credited for the mobilization of more than USD 110 billion of new private sector clean energy manufacturing investments, in addition to the USD 369 billion provided by the public sector.

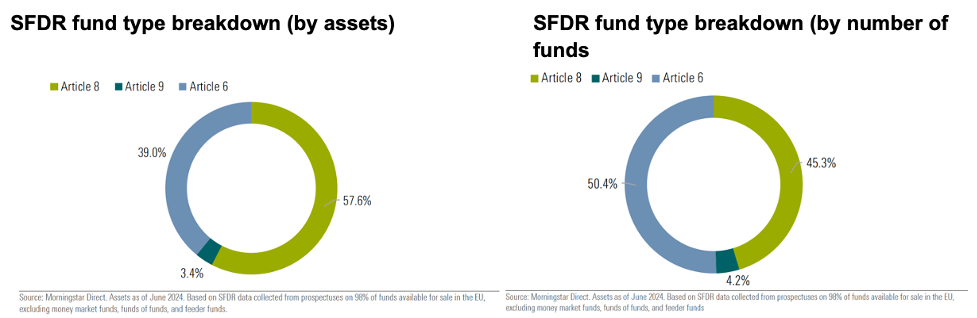

Regulatory interventions in Europe, emerging from the Green Deal, have also advanced the impact investment market, by providing a favorable and credible environment. Two key elements of the EU’s sustainable finance framework are the Sustainable Financial Disclosure Regulation (SFDR), which applies to financial market participants, and the Corporate Sustainability Reporting Directive (CSRD), which applies to large and listed companies. For instance, the classification of funds under Article 8 and 9 provided by the SFDR eases the process for instituional clients to invest in companies that promote environmental or social characteristics. According to Morningstar’s 2024 second quarter report, the combined market share of Article 8 and 9 products (by AuM) measured 61% in June 2024, whereas the market share measured by number of funds reached 49.5%2.

However, in the same account, Morningstar underlined how, whilst Article 8-classified green funds in Europe were recovering compared to the previous quarter (netting EUR 26 billion of new money, versus EUR 18 billion of Q1), Article 9 funds (those receiving the greenest classification) reached withdrawals up to EUR 6.2 billion (up from those of EUR 4 billion of the previous period)[8].

The decrease of Article 9 funds in Europe is to be explained more as the result of increasingly stringent assessment. According to the SFDR definition, Article 9 funds can be considered proper impact investment funds and since the introduction of the EU SFDR Regulation in March 2021, the attitude of the Securities and Markets Authorities has become stricter toward asset managers. Moreover, on May 14th, 2024 ESMA issued stricter Guidelines on funds’ names using ESG or sustainability-related terms that will enter into force on November 21, 2024.

Moreover, on May 14th, 2024 ESMA issued stricter Guidelines on funds’ names using ESG or sustainability-related terms that will enter into force on November 21, 2024.

The challenging business environment over recent months, characterized by high interest rates and global economic and political uncertainties, has not been ideal for impact investment, nor for ESG investment in general. Despite this, the impact investment sector continues to evolve, providing a range of investment products and opportunities for those with available funds[9]. According to a 2023 market analysis report by Grand View Research[10], the global impact investing market will have a CAGR of 18.8% until 2030.

Finally, the SFRD and the CSRD as well as the rise of other impact measurement and reporting standards like the Operating Principles for Impact Management (OPIM[11]) and the Impact Reporting and Investment Standards (IRIS+[12]) drive market growth by not only allowing investors to make informed decisions but also contributing to building credibility and trust in impact investing.

[1] Hand, D., Ringel, B., & Danel, A. (2022). Sizing the Impact Investing Market: 2022. The Global Impact Investing Network (GIIN). https://thegiin.org/publication/research/impact-investing-market-size-2022/

[2] Financial Times. (2024, June 15). ESG funds—How to play a diffuse category. Financial Times. https://www.ft.com/content/9cab7b48-93c9-43fa-8cc9-b4c18e997475

[3] See SVI post of 21/08/2024 ‘The ESG Debate: Is The ESG Party Over In The Usa And In Europe?’ https://en.sustainablevalueinvestors.com/2024/08/21/the-esg-debate-is-the-esg-party-over-in-the-usa-and-in-europe/

[4] Financial Times. (n.d.). Green bond issuance surges as investors hunt for yield. Retrieved August 27, 2024, from https://www.ft.com/content/ee5186f4-1ecb-4f5a-93d2-e4f7ab57a35d

[5] Eisenberg, M., Labrousse, K., & Baruah, R. R. (2023). Private Market Impact Investing: A Turning Point. World Economic Forum. https://www.weforum.org/publications/private-market-impact-investing-a-turning-point/

[6] Phenix Capital Group. (2024). Impact Fund Universe Report, January 2024. Phenix Capital Group. https://phenixcapitalgroup.com/download-impact-report-jan24-impact-fund-universe-0

[7] Impact Investor. (2024). Guide 2024. Impact Investor. https://impact-investor.com/guide-2024-taking-impact-investing-to-the-next-stage/

[8] Morningstar Sustainalytics. (2024). SFDR Article 8 and Article 9 Funds: Q2 2024 in Review. Morningstar Sustainalytics. https://www.morningstar.com/en-uk/lp/sfdr-article8-article9?utm_source=google&utm_medium=cpc&utm_campaign=MORN-R%3AG%3AS%3ANB%3ASFDR8and9%3AEMEASouth%20SFDR%3ASustainability&utm_content=engine%3Agoogle%7Ccampaignid%3A21247402687%7Cadid%3A697968547824%7Cgclid%3ACj0KCQjwq_G1BhCSARIsACc7NxqYr_3NuJMECvBu3-6kkYz3WO83e7qql-KrCFSu-ToE0xW3-U7Q_qgaAkAnEALw_wcB&utm_term=sfdr%20sustainable%20investment&gad_source=1&gclid=Cj0KCQjwq_G1BhCSARIsACc7NxqYr_3NuJMECvBu3-6kkYz3WO83e7qql-KrCFSu-ToE0xW3-U7Q_qgaAkAnEALw_wcB

[9] Impact Investor. (2024). Guide 2024. Impact Investor. https://impact-investor.com/guide-2024-taking-impact-investing-to-the-next-stage/

[10] Grand View Research. (2023). Impact Investing Market Size, Share & Trends Analysis Report By Asset Class, By Offerings, By Investment Style, By Investor Type, By Region, And Segment Forecasts, 2023—2030. Grand View Research.https://www.grandviewresearch.com/industry-analysis/impact-investing-market-report

[11] OPIM: https://www.impactprinciples.org/

[12] IRIS+ System: https://iris.thegiin.org/