23 Aug 2024 Decreasing momentum for anti-ESG shareholders proposals in the USA at H1 2024 AGMs and stagnant support for the ESG-related proposals

In recent years, shareholder proposals[1] on ESG topics have become increasingly prevalent and have garnered significant attention from researchers.

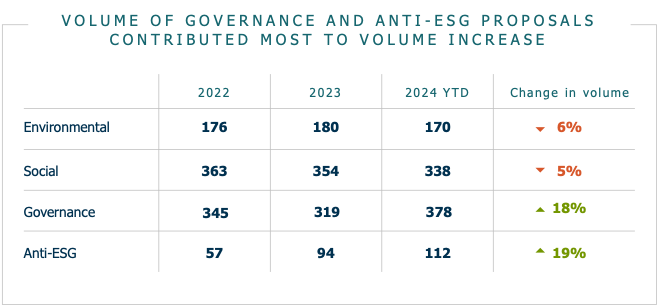

Two 2024 reports analyzing ESG and anti-ESG shareholder proposals within the Russell 3000 index (including the 3,000 largest publicly traded companies in the USA) have evidenced this trend. The first one made by governance consulting firm Georgeson and the second one by proxy advisor ISS STOXX, they both highlight that the filing of ESG and anti-ESG proposals increased in H1 2024.

As it can be seen in the synthetic table above, Georgeson report identified 998 ESG-related proposals filed in 2024 (up from 947 and 941 over the same periods in 2023 and 2022 respectively). Notably, the number of Environmental proposals decreased by 5% vs 2023, the number of Social proposals by 6% and the number of Governance proposals rose by 18%. But in 2024, also the numbers of anti-ESG proposals increased consistently by 19% vs. 2023.

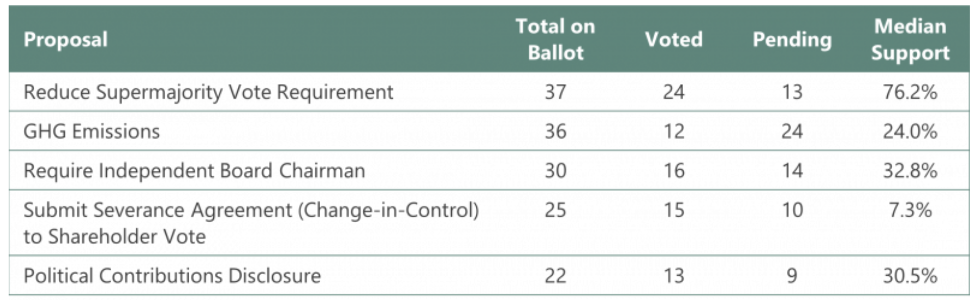

The most common environmental proposals focused on greenhouse gas (GHG) emission reduction policies, particularly scope 3 emissions, and the introduction of sustainable packaging. Support for environmental proposals averaged 22% in 2024, down from 24% in 2023 and 39% in 2022.

Social proposals primarily concern diversity and inclusion policies, such as racial equality audits and pay gap analyses. Average support for social proposals also declined, registering 21% in 2024, compared to 22% in 2023 and 29% in 2022.

Governance proposals commonly involve reducing supermajority voting requirements, increasing the number of independent directors, and modifying the frequency of special shareholder meetings. Support for governance proposals averaged 36% in 2024, up from 29% in 2023 and down from 37% in 2022.

Finally, 71% of anti-ESG proposals targeted social issues, particularly diversity and inclusion policies, which some investors believe negatively impact financial performance. Despite the growing number of anti-ESG proposals, support for them remains low and has steadily decreased from 7% in 2022 to 5% in 2023 and 3% in 2024.

In conclusion, while the number of both ESG-related and anti-ESG shareholder proposals is increasing, their support remains somewhat stagnant for ESG-related proposals and very low and decreasing for anti-ESG proposals.

For further information on the two researches, please consult following links:

https://www.georgeson.com/us/insights/2024-proxy-season-early-look

https://corpgov.law.harvard.edu/2024/06/03/pro-esg-shareholder-proposals-regaining-momentum-in-2024/

[1] A shareholder proposal is a recommendation submitted by a company’s shareholders to influence a company’s policy or strategy. These proposals are then voted on during shareholder meetings.