05 Aug 2024 Carbon pricing in the UK

One of the most concerning problems today is excessive greenhouse gas (GHG) emissions. To try to tackle this problem many governments use carbon pricing, a policy that assigns a cost to the release of GHG. This post will present an overview of the United Kingdom’s carbon pricing policy and compare it to the policy implemented in the European Union which was discussed in the previous post.

Before exiting the European Union, the UK was a part of the EU Emission Trading Scheme (ETS). After Brexit, the UK government introduced its own ETS in 2021. Under the Emission Trading Scheme which is also called a cap-and-trade scheme, the UK government introduces a limit (cap) on the maximum amount of GHG emissions produced in the UK economy over a year. The cap is then split into emissions permits, i.e., rights to emit a certain amount of GHG. These permits are then auctioned to the companies operating in the UK. The companies who received permits can later sell them, creating a market for GHG emission allowances.

The cap on the total amount of emissions is decreased every year allowing the government to lower GHG emissions gradually. For instance, in 2024, the UK reduced the cap by 12.4% compared to the 2023 level. By 2027 and 2030, the UK government plans to reduce the cap by 45% and 75% respectively compared to the 2023 level. The UK is committed to reaching net zero GHG emissions by 2050, which means that total GHG emissions would be equal to the emissions removed from the atmosphere.

The UK ETS covers energy-intensive industries (such as steel production, chemical production, and paper production), the power generation sector, and aviation. Hospitals and small emitters enjoy preferential treatment: they are subject to emission targets instead of having to buy emission allowances.

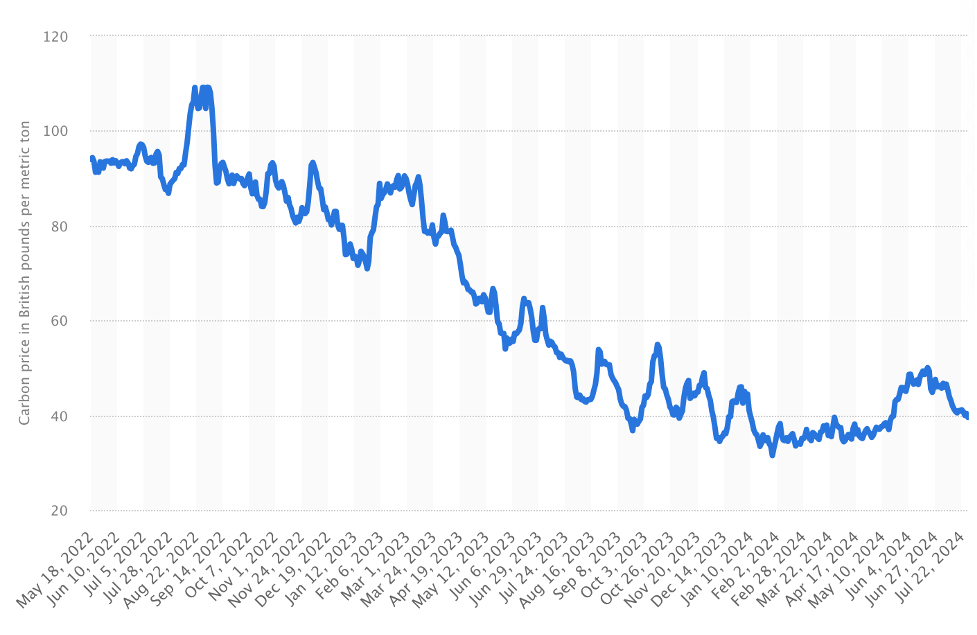

As mentioned before, the UK ETS scheme creates a market for GHG emission permits. The price of emission permits (which is also called carbon price) under the UK ETS is shown in the graph below. One can see that in May 2022 to July 2024 permit price tends to decrease over time. This trend presents a problem for the UK government as falling prices of GHG emission allowances might discourage firms from making an effort to emit less.

https://www.statista.com/statistics/1322275/carbon-prices-united-kingdom-emission-trading-scheme/

Governments trying to reduce GHG emissions often encounter the problem of carbon leakage which occurs when businesses transfer their production to jurisdictions with less stringent environmental regulations. To support UK producers in industries subject to the carbon leakage problem (such as the steel industry), the UK government gives them for free a part of the emission allowances instead of auctioning them. To further tackle carbon leakage, the UK government plans to introduce the Carbon Border Adjustment Mechanism (CBAM) in 2027. This policy will consist of a tariff on imported carbon-intensive goods. The tariff will initially apply to the imports of aluminum, cement, ceramics, fertilizer, glass, hydrogen, iron, and steel. However, later this list may be extended. The UK government has yet to publish precise rules of the CBAM. The detailed plan is likely to be published by the end of 2024.

The UK Emission Trading Scheme largely mirrors the EU ETS. Both policies use a market-based approach to carbon emission regulation and employ a cap-and-trade scheme. However, the UK ETS tends to reduce the emission cap significantly faster than the EU ETS: the annual reduction rate is 4.2% in the UK versus 2.2% in the EU.

Nevertheless, despite the higher annual reduction rate of the emission cap, the carbon price in the UK is significantly lower than in the EU. Furthermore, emission permit price in the UK tends to fall over time while the carbon price in the EU tends to rise.

Another difference between the UK and the EU policies is the speed of implementing the Carbon Border Adjustment Mechanism. The EU plans to implement CBAM in 2026, one year earlier than the UK. Furthermore, the EU has already started the transition phase toward the CBAM: in 2023-25 importers will have to disclose emissions embedded in imported products but will not have to pay fees for these emissions. At the same time, the UK is still holding consultations on the exact details of its CBAM policy.

For further information on carbon pricing and the UK ETS, please consult the following links:

https://cherwell.org/2021/01/23/introducing-the-uk-emissions-trading-system/