07 Oct 2020 Solving the “Alphabet Soup” of ESG Reporting: a pre-requisite to enable Stakeholder Capitalism

As a response to the fragmented environment of ESG reporting, the international community has begun taking its steps towards harmonization. After a joint vision has been shared by the five leading Framework and Standard-setting Institutions, also the Big Four Accounting Firms have recently disclosed a new coordinated measuring framework for Stakeholder Capitalism.

The currents state of the art on ESG reporting is a misfit puzzle of different measures, standards, approaches, and best practices. According to Brian Moynihan, Chief Executive of Bank of America, solving this measurement uncertainty would provide a strong incentive to private investors in redirecting their capital towards the area of sustainable investments.

This, however, is only part of the story, and an even more worrisome consequence should be underlined. Paul Andrews, Secretary-General of the International Organization of Securities Commissions, stated in fact that it is precisely the available plethora of sustainability frameworks that provide companies leeway in their ESG risk reporting. Not only this hinders comparability, but leaves the door open to green- and social-washing. A recent article of ours, discussing Boohoo’s good ESG ratings in face of the exploitation of modern slavery, precisely exemplifies this risk (http://en.sustainablevalueinvestors.com/2020/08/04/boohoo-received-good-esg-ratings-despite-exploitation-of-modern-slavery-in-its-supply-chain/).

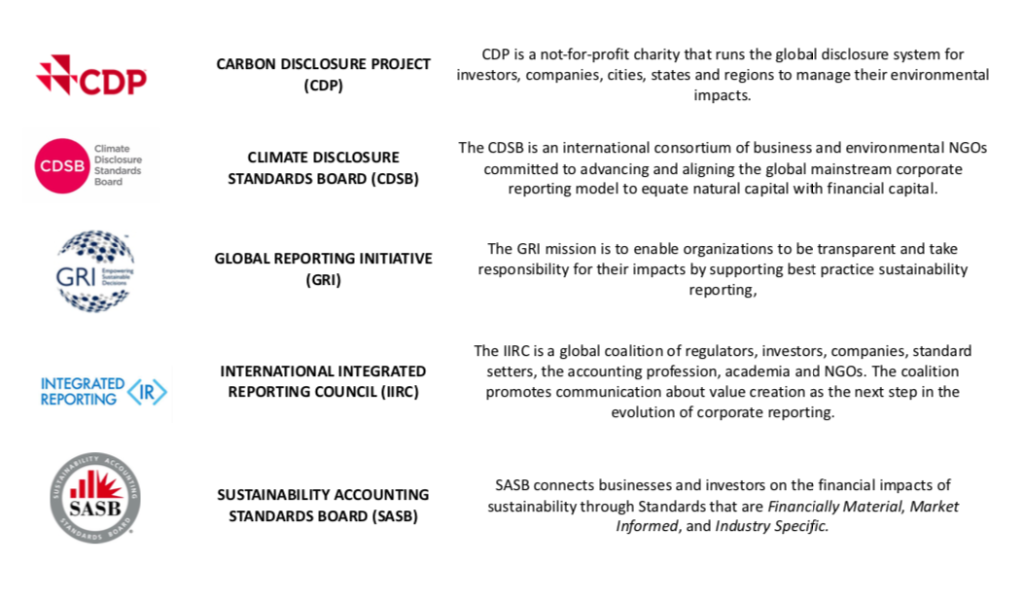

Source: SVI compendium of data retrieved from the Organizations’ websites (www.cdp.net/enwww.cdsb.net, www.globalreporting.org, www.integratedreporting.org, www.sasb.org)

As the international community has begun to recognize these issues, some progress is in the making. At the beginning of September, the five leading Framework- and Standard-setting Institutions (Carbon Disclosure Project, Climate Disclosure Standards Board, Global Reporting Initiative, International Integrated Reporting Council, and Sustainability Accounting Standards Board) released a “Statement of Intent to Work Together Towards Comprehensive Corporate Reporting”, providing:

- Joint market guidance on how frameworks and standards could be applied in a complementary and additive way;

- A joint vision of how they could complement financial generally accepted accounting principles (Financial GAAP) and lay the foundation for a more comprehensive corporate reporting system; and

- A joint commitment to drive toward this goal through deeper collaboration.

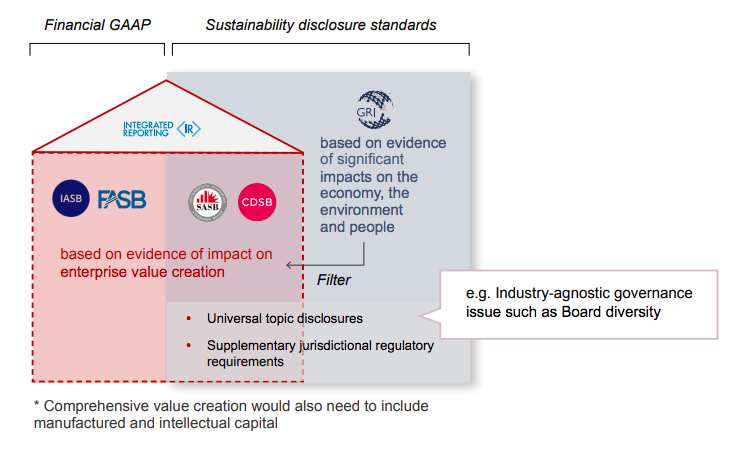

The most important takeaway of the report can be synthesized through the flow represented in the figure below: sustainability disclosure standards focused on enterprise value creation should be connected to Financial GAAP, with integrated reporting as the conceptual framework that could allow for this bridging.

Source: Statement of Intent to Work Together Towards Comprehensive Corporate Reporting, CDP, DCSB, GRI, IIRC and SASB, September 2020.

An even more recent initiative undertaken by the Big 4 Accounting Firms (Deloitte, EY, KPMG and, PwC) and spearheaded by the International Business Council could move the status quo even further. After a consultation process that took place from January to July 2020 and that involved representatives from corporations, investors, standard-setters, NGOs, and international organizations, a new coordinated framework to ESG reporting has been publicly disclosed during the 2020 World Economic Forum. Among its key goals, the contribution to a growing understanding of ESG’s financial materiality and the enablement of transparency and market efficiency for investors.

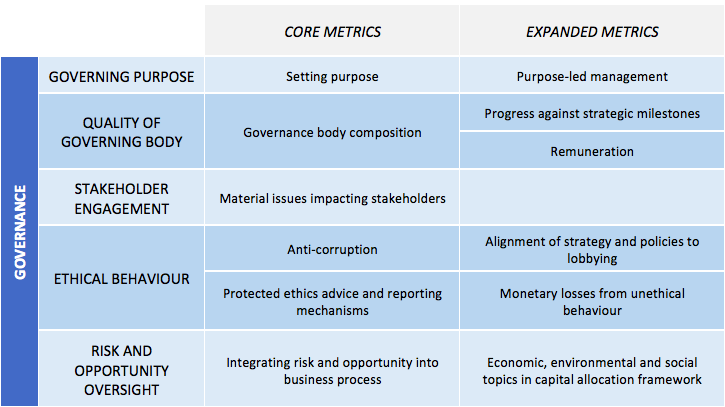

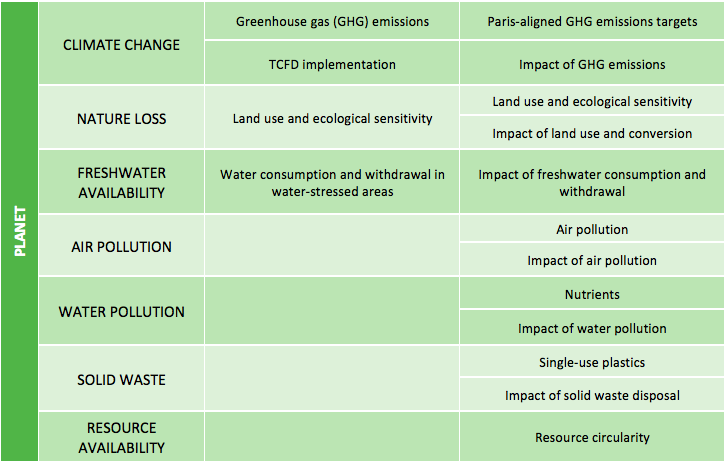

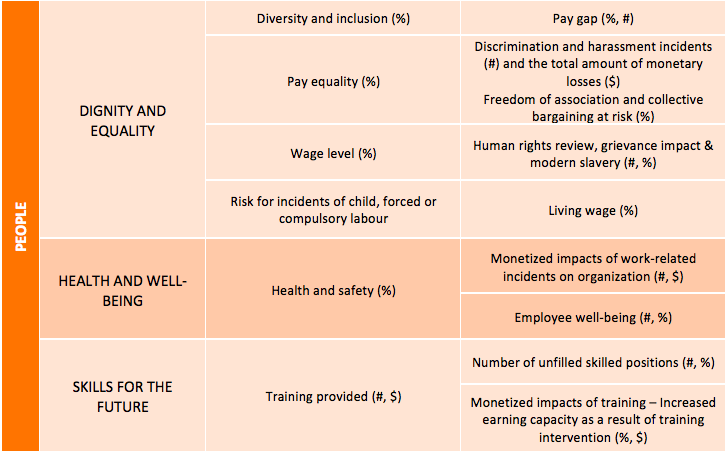

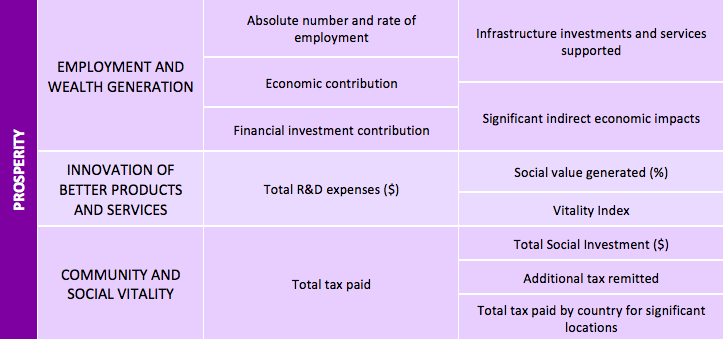

Source: The four pillars were developed by the World Economic Forum in discussion with Deloitte, EY, KPMG and PwC. Definition for Governance developed by Deloitte. Definitions for Planet, People and Prosperity taken from “Transforming our world: the 2030 Agenda for Sustainable Development”, United Nations, 2015.

The framework accounts for 21 core metrics and 34 expanded metrics spanning across four key pillars – Governance, Planet, People, and Prosperity – that are, still, ultimately interrelated and mutually-reinforcing. Compared to the usual ESG triad, the prosperity pillar has been added as a fourth dimension encompassing the importance of prosperous societies and the role of businesses in fueling economic growth, innovation, and shared wealth.

Whereas core metrics are already more commonly leveraged by companies as they focus primarily on activities within an organization’s own boundaries, expanded metrics tend to be less well-established. These, in fact, not only and have a wider value chain scope, but represent a more advanced way of measuring and communicating sustainable value creation.

Source: SVI compendium of data retrieved from “Transforming our world: the 2030 Agenda for Sustainable Development”, United Nations, 2015.

In approaching these metrics, however, three additional elements should be taken into consideration. First, this framework is purposely universal and industry-agnostic, meaning that it could be useful to any company irrespective of its sector of operation. From this naturally follows that, according to its own specificities, every corporation should complement this baseline framework with additional and materially relevant metrics.

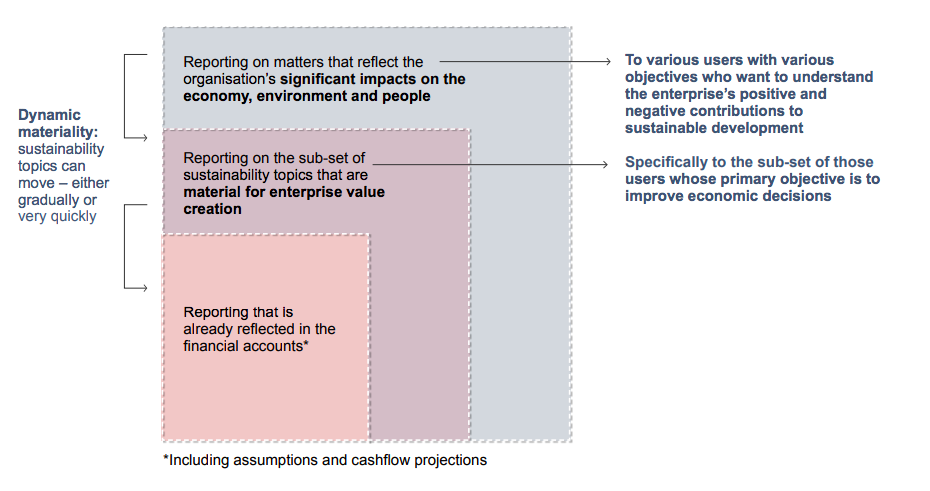

Second, the concept of Dynamic Materiality recognizes that issues once considered relevant only to social value can rapidly become financially material. On a first dimension, this implies that sustainability topics can gain materiality based on evidence of an organization’s impacts on the economy, environment and/or people, but on an additional level, it also signals that sustainability topics could become material for enterprise value creation, as it has recently occurred with a long-due recognition of racial equity matters.

Third, whenever companies are unable to report on a specific metric, they should comply with the “disclose or explain” principle, explicating the reasons underpinning the omission.

Source: Statement of Intent to Work Together Towards Comprehensive Corporate Reporting, CDP, DCSB, GRI, IIRC and SASB, September 2020. The dotted lines are in the figure above are referred to as “dynamic materiality borders”.

For further information see the following links:

- https://www.ft.com/content/16644cb2-f0c1-4b32-b44c-647eb0ab938d

- https://www.ft.com/content/4d7accf7-5431-4ebb-a528-87db3cca1eb7

- https://www.ft.com/content/876f143a-36de-11ea-a6d3-9a26f8c3cba4?emailId=5f69c851c597cc0004aa3376&segmentId=a8cbd258-1d42-1845-7b82-00376a04c08f

- https://www.ft.com/content/5ac97210-98f0-3e19-8fd0-bebbc0658e83

- https://www.weforum.org/events/sustainable-development-impact-summit-2020/sessions/esg-report-launch-times-shown-are-cet

- https://www.accountingtoday.com/news/big-four-firms-release-esg-reporting-metrics-with-world-economic-forum

- https://www.accountingtoday.com/news/sustainability-standard-setters-pledge-to-work-together-on-common-goals

- https://29kjwb3armds2g3gi4lq2sx1-wpengine.netdna-ssl.com/wp-content/uploads/Statement-of-Intent-to-Work-Together-Towards-Comprehensive-Corporate-Reporting.pdf

- http://www3.weforum.org/docs/WEF_IBC_Measuring_Stakeholder_Capitalism_Report_2020.pdf