15 Jul 2020 Social impact bonds have outpaced green bonds during Covid-19 pandemic

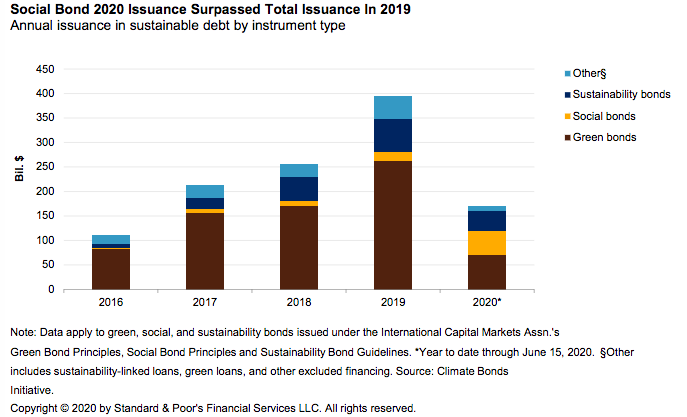

The issuance of social bonds has outpaced that of green bonds this year, reflecting a diversification in sustainability investments and increasing attention by investors on social matters and social risks in light of the challenges brought by COVID19.

Covid-19 has brought investors increasing attention on social matters and social-related risks. At the same time, organizations worldwide have been required leadership actions to address the challenges carried by the pandemic, such as job losses, increased death rate, raised pressure on health care systems. The need to mitigate such social risks translated into the capital markets as well, in particular through the growing issuance of social bonds.

The International Capital Markets Association (ICMA) defines social bonds as securities whose proceeds are used to finance projects with positive social impact. According to data released by Morgan Stanley, $32billion of “social” and “sustainability” bonds were issued in April 2020, surpassing green bonds. In 2019, social bonds were issued for almost $20billion, accounting for 5% of the overall sustainable debt issued during the year.

Government agencies and international organizations have been the dominant issuers of social bonds in the past years. During the pandemic, they have increased social bond issuance through the launching of “Covid bonds”, designed to finance the response to the health crisis and which have contributed mainly to the rapid growth of social bonds on the debt market. Corporations are also becoming more active in issuing this type of bonds, raising their share by 10% in 2019 from the previous year. In June of this year, the Ford Foundation announced it will issue $1billion of social bonds becoming the first nonprofit organization to launch them on the American corporate bond market.

Emerging markets have registered an increase in social bond issuing, doubling the value of the issuance to $5.2billion so far this year, with Asia-Pacific and Latin American markets representing 29% and 7% of the current issuance and making Europe go from an 80% share to 40% this year.

“Some emerging trends could support long-term growth in social bond issuance, including aging populations in developed countries, increased concerns over food security, and growing health-driven consumer preferences. […] we expect social bond issuers to include more public issuers such as sovereigns, sub-sovereigns, public agencies, and foundations/not-for-profits since they have a wider mandate to provide social services than private institutions” S&P said. Regarding companies’ participation in social bond issuance, S&P added: “We believe a company’s response to these social disruptions can provide visibility into its level of preparedness, not just for pandemics, but for unforeseen risks in general. As a result, even amid today’s tumultuous economy, we expect social bond issuance will persist as companies demonstrate sensitivity to a variety of social issues and work avidly to mitigate their exposure”.

For further information, see the following links:

- https://www.spglobal.com/ratings/en/research/articles/200622-a-pandemic-driven-surge-in-social-bond-issuance-shows-the-sustainable-debt-market-is-evolving-11539807

- https://think.ing.com/articles/sustainable-finance-green-bonds-fade-social-bonds-flare/

- https://www.ai-cio.com/news/pandemic-spurs-investor-interest-social-bonds/

- https://www.ft.com/content/03dbe400-1bea-4475-bda7-2fbc1d9ce062

- https://www.ft.com/content/d35d1abc-0a4e-4e09-a776-154a469ef8de