04 Jul 2020 Wirecard scandal: a story of fraud and auditing negligence

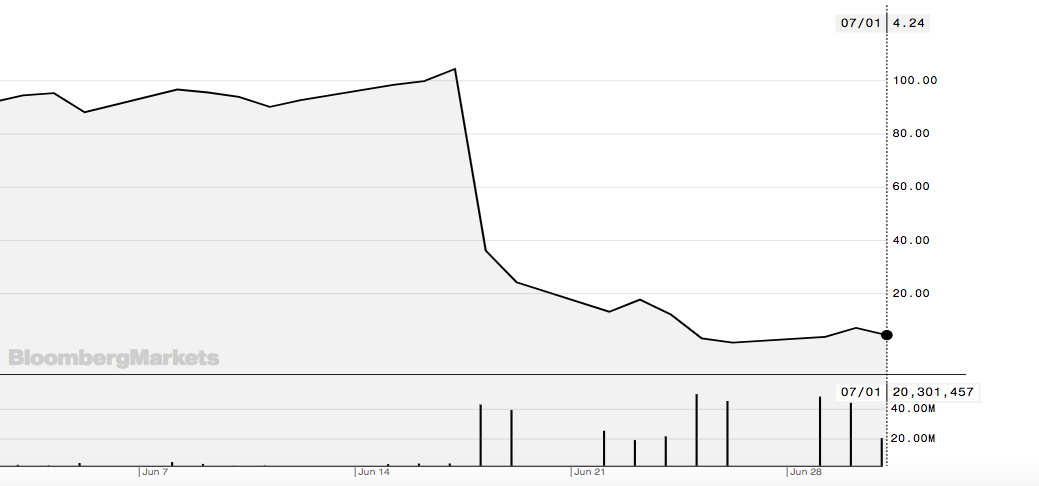

Wirecard’s share price has collapsed after the exposure of its fraud scheme.

On Thursday, June 18th 2020, Wirecard’s auditor, EY, stated that, when carrying out its 2019 audit of the firm, it could not find $2 billion in the company’s accounts, funds that the German firm later said that probably “did not exist”. Later that week, Wirecard filed for insolvency.

According to the firm’s previous management, the cited accounts were used to settle operations with partners who acted on the Wirecard’s behalf in countries where it did not have proprietary licenses to process electronic payments. In this regard, however, EY declared that “there are clear indications that this was an elaborate and sophisticated fraud involving multiple parties around the world in different institutions with a deliberate aim of deception”. This fraud is similar to the Italian Parmalat case of twenty years ago, in which the firm falsified the financial statements claiming to have liquid funds (which later turned out to be non-existent) deposited in Caribbean tax havens.

Wirecard, a German provider of software and systems for online payments and fraud protection, is the first insolvent company in the DAX 30 (Germany’s premier stock-market index). As a consequence of the auditor’s announcement, Wirecard shares have collapsed by more than 90% over the last week. Wirecard’s CEO and large shareholder, Markus Braun, has stepped down from the company and has been accused by German prosecutors of distorting the firm’s earnings by inflating its sales with falsified income, using third-party partners providing payment-related service abroad and whose revenues were supposedly deposited in the mentioned accounts. Furthermore, the German payment company has misled the market about its real scale, with actually only 100 customers accounting for more than half of its sales. Following the charges, Markus Braun was arrested and then released on bail a few days after.

Doubts regarding Wirecard’s financial statements have been raised for years, with the most recent case before the scandal being in 2019, when the Financial Times questioned the company’s accounting practices in Singapore and other Asian countries. After FT allegations, the firm hired KPMG LLP as a second auditor to look into the issue raised. In April of this year, KPMG released a report stating that it could not confirm the arrangements with the third-party partners due to a lack of cooperation from Wirecard. After that, EY came forward too and informed the company’s board that it was incapable to find adequate data to confirm cash balances on trust accounts.

Not surprisingly, the scandal has affected EY as well, as the auditor firm has been accused of failing, for many years, to request external information (in addition to the documents provided by the corporation) to verify the existence of the overmentioned account, a procedure that could have exposed the fraud by Wirecard earlier. This means that EY issued faulty audits on the firm for years, despite increasing suspects on financial misconduct by the German company. For this reason, EY is currently facing a class-action lawsuit brought by German Wirecard investors.

EY already has a history of wrong audits. In April of this year, Luckin Coffee Inc, a Chinese coffee group audited by EY has confessed that $310 million of its 2019 revenues had been fabricated, as many anonymous reports have alleged in the preceding months. In Denmark, EY has been brought before the Danish Disciplinary Board of Auditors in 2020 over incorrect auditing of Danske Bank’s 2014 accounting statements linked to a $200 billion money-laundering scandal.

German regulators have received accusations too, claiming that they failed to adequately supervise Wirecard, which has been audited by EY for a decade. This might impair the reputation of the country’s financial services industry, undermining the possibility to become the new financial center in the European Union after the Brexit.

For further information, see the following links:

- https://www.nytimes.com/2020/06/25/business/wirecard-insolvency-bankruptcy.html?searchResultPosition=2

- https://www.nytimes.com/reuters/2020/06/25/business/25reuters-wirecard-accounts-ey.html?searchResultPosition=2

- https://www.ft.com/content/a9deb987-df70-4a72-bd41-47ed8942e83b

- https://www.wsj.com/articles/wirecard-files-for-insolvency-after-revealing-accounting-hole-11593075223?mod=searchresults&page=1&pos=7

- https://www.wsj.com/articles/wirecard-scandal-puts-spotlight-on-auditor-ernst-young-11593286933?mod=searchresults&page=1&pos=3

- https://www.ft.com/content/e037d830-cfd8-4bca-853d-d49f48e67f13

- https://www.washingtonpost.com/business/how-german-fintech-darling-wirecard-fell-from-grace/2020/06/26/da496276-b7cd-11ea-9a1d-d3db1cbe07ce_story.html

- https://www.ft.com/content/7c466351-02fe-4d66-85a1-53d012de7445

- https://www.ilsole24ore.com/art/i-2-miliardi-cassa-spariti-ex-star-borsa-wirecard-germania-inciampa-suo-caso-parmalat-AD6o5lZ