17 May 2020 Millennials and women key drivers of ESG investments widening the gap between winners and losers

The universe of investment is changing. Millennials are twice as likely to invest in sustainable investment products as the rest of the investors. If responsible investments are considered a niche choice for the majority of the investors, they have become the norm for women and millennials demanding that their portfolios have a positive social impact.

According to Schroders, 78 percent of investors say that sustainable investing has become more important to them in the past five years, while 64 percent increased their sustainable investment allocations this year.

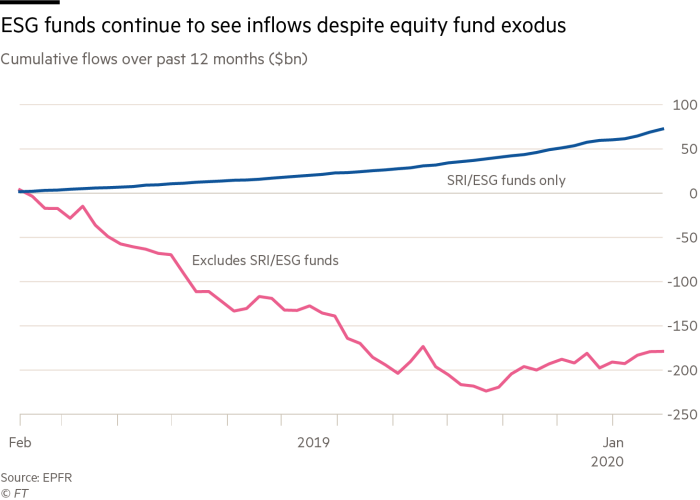

Interest in ESG-oriented investing has skyrocket lately. Many investors demand that companies do better on a wide variety of matters that fall under the ESG umbrella. ESG-focused equity funds have taken in nearly $70bn of assets just over the past year, according to EPFR, while traditional equity funds have suffered almost $200bn of outflows over the same period.

Asset managers tend to define ESG, or “socially responsible investing”, differently, or weight metrics in conflicting ways. But look under the hood of some of the biggest ESG funds and it becomes apparent that they are heavily tilted towards tech stocks, including Microsoft.

“Given the unprecedented media attention focused on sustainability and its relative immaturity as an investment style, ESG is having a fast-growing impact on equity market positioning,” Barclays said in a recent report. “We believe that it is likely contributing to widening the valuation dispersion between ‘winners’ and ‘losers’.”

Mr Klarman of Baupost, a value-oriented hedge fund, bemoaned the environment in his latest letter to clients, but argued that the “ongoing selling pressure of value names has contributed to mispricings that represent potential opportunity for long-term investors”.

Over time, the shunning of companies that lag behind on ESG metrics may indeed lead to investors being able to harvest a “sin premium” by buying systematically underpriced stocks. However, given the fact that ESG-focused investing is likely to prove a secular trend, it might also mean that value will stay in a funk far longer than its proponents might like.

https://www.ft.com/content/12bd616e-442b-11ea-a43a-c4b328d9061c

https://www.schroders.com/en/us/insights/global-investor-study/2017-findings/sustainability/

https://www.ft.com/content/cb1e2684-4152-11ea-a047-eae9bd51ceba