14 Dec 2019 US$ 534 bn of market value has been lost due to ESG controversies

Major ESG-related controversies during the past six years were accompanied by market capitalization losses of $534 billion for large US companies over the past 5 years, according to an analysis by Bank of America Merrill Lynch.

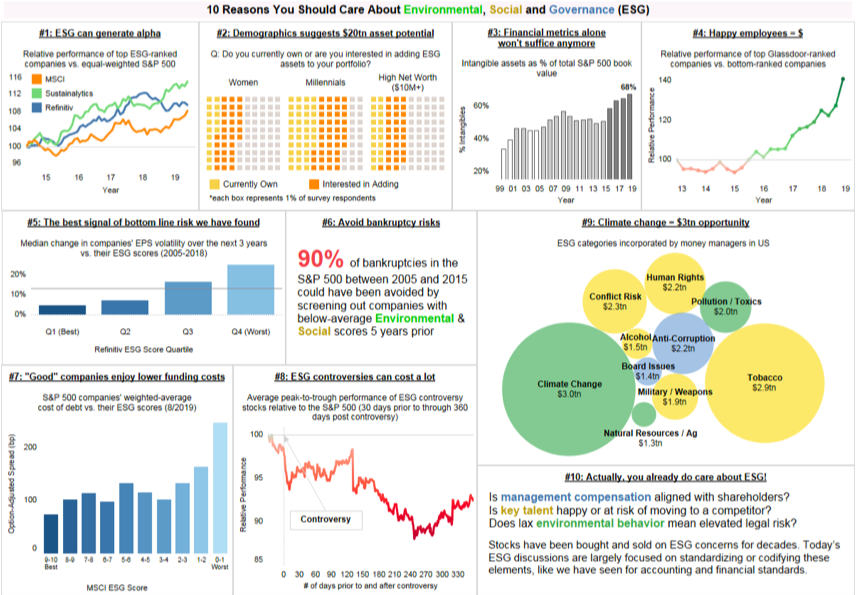

The research shows that “90% of bankruptcies in the S&P 500 between 2005 and 2015 could have been avoided by screening out companies with below-average Environmental and Social scores five years prior to the bankruptcies.”

Loss avoidance is key for portfolio returns over time. The EU has fined Google €8.2bn over the past two years for antitrust violations, while in July Facebook agreed to a $5bn settlement in the US over privacy concerns.

“The hit to market value of an ESG controversy is significant and the impact is long-lasting. It can take a year for a stock to reach a trough following an ESG controversy,” said Savita Subramanian, head of US equity and quantitative strategy at Bank of America. “Negative headlines stick in investors’ minds.”

Increasingly, it is expected to approach the importance of financial reporting. Along the way, ESG is increasingly gaining importance in assessing a company’s sustainability performance.

Indeed, “ESG is the new CSR,” declared Forbes recently, arguing that ESG will most likely replace CSR as the corporate vehicle for positive contribution. Hence, CSR, which is often a disconnected department with limited resources, will turn into ESG with a fully integrated strategic objective that’s closely connected to the mission of the company.

Results from BAML’s Global Wealth and Investment Management survey showed that 67% of financial advisors have clients that have expressed interest in ESG factors. High-net worth investors, millennial investors, and women are the three groups that have the highest interest in ESG investing.

“Based on demographics, we estimate over $20 trillion of asset growth in ESG funds over the next two decades,” the analysts wrote. That’s equivalent to the size of the S&P 500 today.

Climate change is the top-ranked ESG concern for ESG asset managers, according to the US Forum for Sustainable and Responsible Investment, with $3tn of ESG assets considering climate change as part of their investment decisions. According to the CDP (Climate Disclosure Project), $970bn worth of assets could be at risk within the next five years, based on estimates provided by 215 companies — some of the largest in the world.

Moreover, companies with higher ESG scores have access to cheaper capital. “Just like consumers have credit scores, companies pay different rates depending on their risk profiles,” the analysts wrote. The cost of debt for companies with better ESG scores can be nearly 2% lower than companies with worse scores.

Links:

https://www.bofaml.com/content/dam/boamlimages/documents/articles/ID19_1119/esg_matters.pdf

https://www.ft.com/content/3f1d44d9-094f-4700-989f-616e27c89599