21 Aug 2024 The ESG debate: is the ESG party over in the USA and in Europe?

On July 17th, 2024, the FT has published an interesting documentary under the title ‘Who killed the ESG party’ that inquires which were the 4 main culprits that contributed to kill the ESG party. In the following we want to briefly analyze the ESG growth and when it became a party.

It is true that after more than a decade when ESG was unknown or neglected by the vast majority of investors, it finally became mainstream in the last 5-8 years.

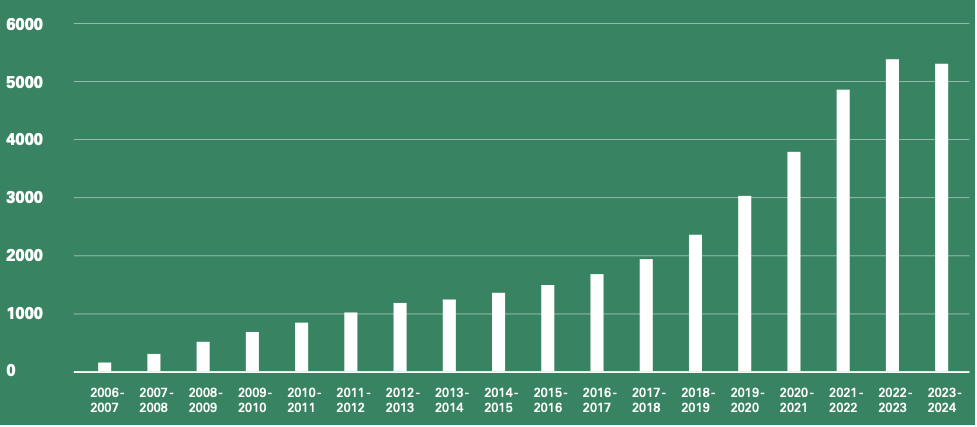

The growth by financial year of the total number of UN PRI (Principles of Responsible Investments) signatories reported in the graph below shows this trend. PRI signatories nearly tripled from 2016-2017 until 2022-2023 and in 2023-2024 for the first time there was a decrease of 0.83% to a total number of 5,345 signatories (of which 4,827 investors and 518 service providers). Whereas, total signatory AUM remained strong at US$128.4 trillion in 2023-2024 (up from US$121.3 trillion at the end of March 2023).

Source: 2024 PRI Report

Once ESG became mainstream, it also started the ESG party where all market players wanted to participate and be considered insightful (strategic consultants, auditors, etc.). ESG pioneers had difficulties to accept it, since ESG was meant as an exercise to empower the fiduciary duties of asset owners and their agents, asset managers. However, once ESG are being incorporated in traditional finance, the mission the UN PRI aspired to when they were first launched in 2006 by former UN secretary Kofi Annan can be considered accomplished? Things happened in-between that killed the party. Ukraine invasion by Russia and the opposition by republican States in the USA resounding in the new-streaming platform led by Tucker Carlson. Red-state politicians have sought to blacklist banks and asset managers they deem to be boycotting fossil fuels. It makes sense to note that ESG is not about ideology and politics.

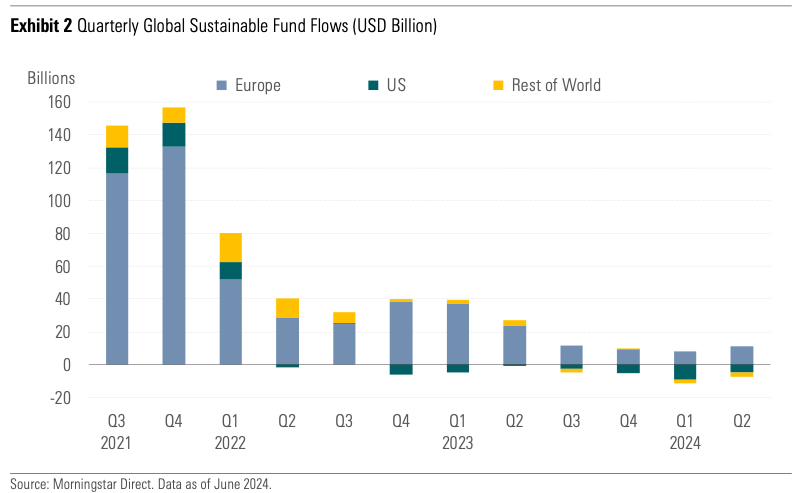

In the table below are reported the in-flows in Europe and out-flows of ESG funds in the USA in 2021-2024.

From the analysis of these numbers, it has to be noted that even in Europe the big inflows in ESG funds was in 2021 with the introduction of the EU SFDR, the EU Regulation on sustainability‐related disclosures in the financial services sector. Later the toughest attitudes by the Regulators on preventing greenwashing, has contributed to a deceleration. See also the DWS greenwashing scandal and the contribution by dismantle ESG by former DWS Sustainability Officer, Desiree Fixler, fired in 2021.

On the other side, high commodity prices in the wake of Russia’s full-scale invasion of Ukraine pushed oil and gas companies globally to record profits in 2022. US oil production in November 2023 hit an unprecedented 13.3mn barrels a day, while natural gas topped 105bn cubic feet a day for the first time. USA overtook Qatar to become the largest exporter of liquefied natural gas in the world last year.

ESG investors notably are engaged in climate change mitigation and adaptation initiatives and also in excluding investment in weapons, but the scenario after February 2022 changed their position. ESG investors in Scandinavia started asking whether they should relax some rules preventing them to invest in the military industry under the pression of the new EU defensive attitude, also many missed out on the oil price surge in 2022, raising questions not only about their short-term performance but also their long-term strategy in a world that might need fossil fuels for longer than people had hoped.

Stuart Kirk, former HSBC’s head of responsible investing, who accused central bankers and officials of exaggerating the financial risks of climate change, was pressed to resigned in July 2022.

For further information on the ESG debate, please consult following links:

https://www.ft.com/content/2030c018-9668-4682-af37-1580cf09d960

https://www.ft.com/video/1eeebd90-25d4-4421-a175-deedcdbf9c18

https://www.ft.com/content/98280875-14d1-4511-b412-4bdcf7260c5e

https://www.ft.com/content/48897f9d-ba89-48c3-abd2-de598db263f1

https://www.ft.com/content/7a98cba4-2977-40d6-bf99-dea74d479607

https://www.ft.com/content/016389b9-8463-4f96-b1a8-0bb811e61e8a